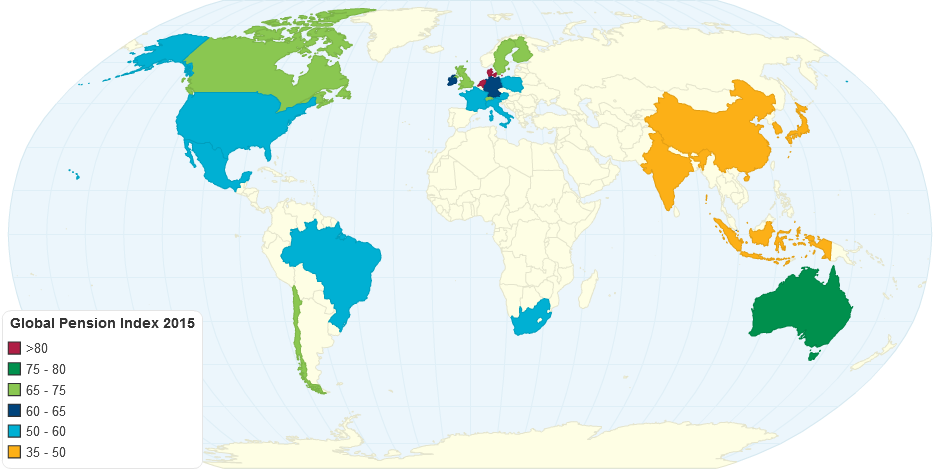

This chart shows the Global Pension Index for the year 2015.

Pension System :

Pension systems around the world, whether they be social security systems or private sector arrangements, are now under more pressure than ever before. Significant pension reform is being considered or implemented in many countries due to:

their ageing populations arising from lower fertility rates and increasing life expectancies

- increased government debt in some countries

- uncertain economic conditions

- record low interest rates

- a global shift towards greater individual responsbility with defined contribution plans.

About the Index :

The Australian Centre for Financial Studies (ACFS) is pleased to present the 2015 Melbourne Mercer Global Pension Index (the Index) in partnership with Mercer. Currenlty in its seventh year, the Index provides a valuable contribution to the global debate about how to best provide for an ageing population.

How is it Calculated?

The overall index value for each country represents the weighted average of the three sub-indices. The weightings used are:

- 40 percent for the adequacy sub-index

- 35 percent for the sustainability sub-index

- 25 percent for the integrity sub-index

The different weightings are used to reflect the primary importance of the adequacy sub-index which represents the benefits that are currently being provided together with some important benefit design features. The sustainability sub-index has a focus on the future and measures various indicators which will influence the likelihood that the current system will be able to be maintained in the future. The integrity sub-index considers several items that influence the overall governance and operations of the system which affects the level of confidence that the citizens in each country have with their system.

Adequacy :

The primary objective of any pension system is to provide adequate retirement income. Thus, this sub-index considers the base level of income provided as well as the net replacement rate for median-income earners.

Sustainability :

This sub-index evaluates the long-term sustainability of the current retirement income system in many countries is a concern, particularly in the light of the ageing population, the increasing ratio of retirees to productive workers and, in some countries, increasing government debt.

Integrity :

It is critical that a nation has confidence in the ability of private sector pension providers to deliver retirement benefits over many years into the future. This sub-index therefore considers the role of regulation and governance, the protection provided to participants and the level of communication provided to members. We consider the requirements set out in relevant legislation. This year we have added an indicator based on the World Bank’s Worldwide Governance indicators.

10 years ago