LendingTree®, the nation’s leading online loan marketplace, has

released the findings of its study on closing timelines for purchase mortgages. The study analyzed data

from a sampling of 10,000 closed loans from August 2016 through July 2017 and reviews the timeline for

the entire mortgage shopping experience - from first submitting a loan request and being matched with

a lender to the date of mortgage closing. The study revealed that the average time to close a purchase

mortgage has declined roughly 74 percent from May 2016 to May 2017.

From 2016 to 2017, LendingTree has seen a 59 percent increase of consumers closing a purchase

mortgage in the first 60 days from its network of consumers who received a purchase loan. This

decrease in time to close is partially due to increased automation and digital integrations. In addition to

shorter closing times, LendingTree has found an increase in average overall ratings for home purchases

on its network in the past two years.

The study’s findings show that time to close is much shorter for refinance loans than for purchase

mortgages. Average time to close for refinance is 20 days less than average time to close for purchase.

The national average for purchase during 2017 was 72.6 days, compared to the national average of 52

days for refinance.

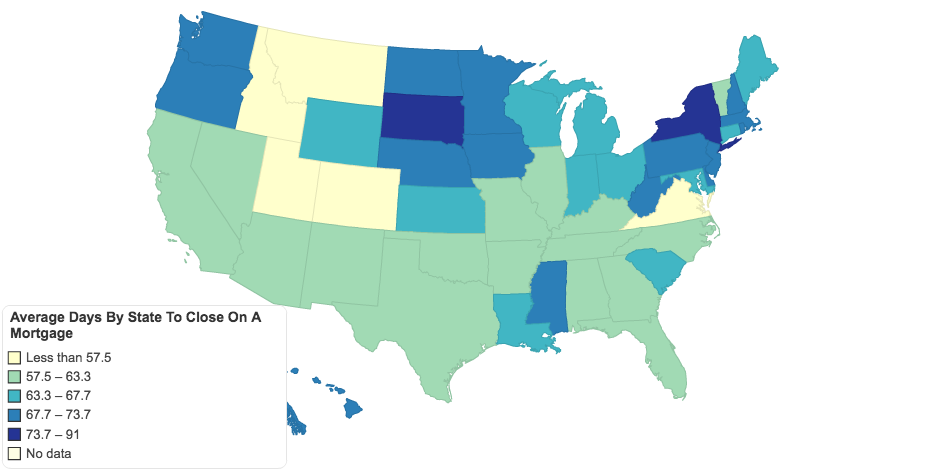

Average closing times varied by metropolitan area and state. Below is a table of time to close in the 20

metropolitan areas from the Case-Shiller Composite 20 Index. Of the 20 metropolitan areas, Boston had

the longest time to close with 79.5 average days to close. Denver had the shortest with 56.2 average

days to close.

8 years ago