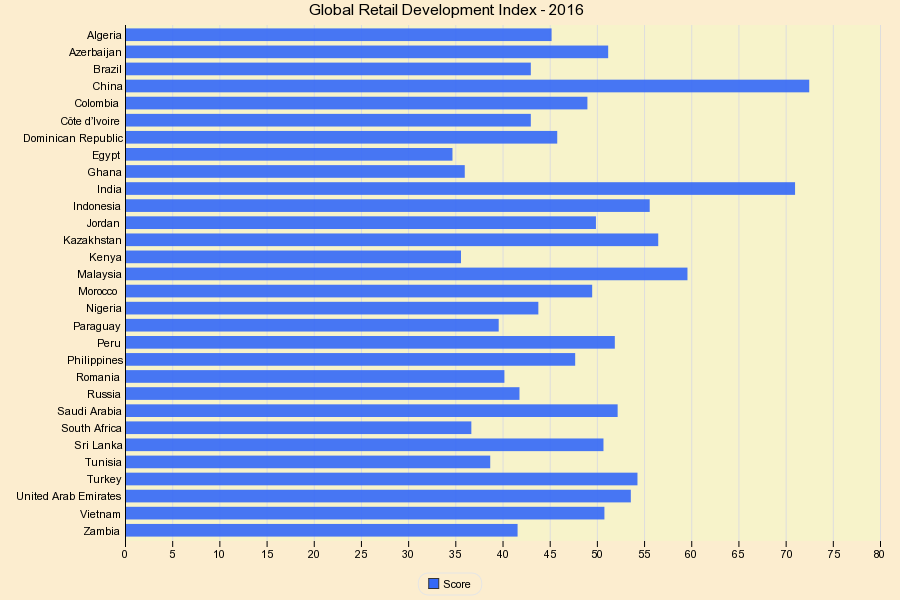

This chart shows Global Retail Development Index - 2016.

Global Retail Development Index has guided global retailers with their strategic investments since 2002, a period in which the retail environment in developing markets has undergone massive transformation. Since the first edition, we have seen retailers entering smaller, prosperous markets as well as large ones, and a game that was once dominated by big-box retailers has now opened up to a great variety of specialty retailers.

International retailers are also now more adept at tackling the individual challenges of each market, which require different strategies for success.

Retailers’ increased understanding of developing countries is more important today than ever before, as these markets struggle with shifting economic and political trends—sometimes in an extremely short timeframe.Overall, retailers over the past year took a longer-term view of developing markets, staying put in turbulent regions while making targeted investments in areas of growth.

The GRDI ranks the top 30 developing countries for retail investment. Using more than 20 macroeconomic and retail-specific variables, we identify not only the markets that are most successful today, but also those that offer future potential.

9 years ago