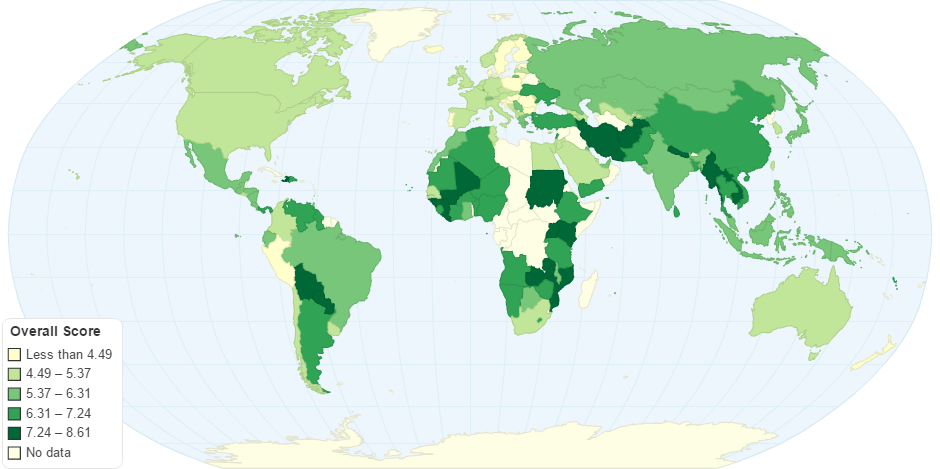

This chart shows Basel Anti-Money Laundering (AML) Index by Country.

The Basel AML Index is an annual ranking assessing country risk regarding money laundering/terrorism financing. It focuses on anti-money laundering and counter terrorist financing (AML/CTF) frameworks and other related factors such as financial/public transparency and judicial strength.

The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. A total of 14 indicators that deal with AML/CFT regulations, corruption, financial standards, political disclosure and rule of law are aggregated into one overall risk score. By combining these various data sources, the overall risk score represents a holistic assessment addressing structural as well as functional elements in the AML/CFT framework.

As there are no quantitative data available, the Basel AML Index does not measure the actual existence of money laundering activity or amount of illicit financial money within a country but is designed to indicate the risk level, i.e. the vulnerabilities of money laundering and terrorist financing within a country.

The methodology remains, when a key methodological adjustment was conducted. It takes into consideration the modifications brought to the assessment mechanism of the FATF Mutual Evaluation Reports. For the first time they include an effectiveness assessment in addition to the assessment of legal compliance with the FATF recommendations. While last year five countries were assessed according to the new FATF methodology, this year’s edition includes 14 countries with the new FATF Mutual Evaluation Reports as a source for the Basel AML Index.

Money laundering is the process of transforming the proceeds of crime and corruption into ostensibly legitimate assets. In a number of legal and regulatory systems, however, the term money laundering has become conflated with other forms of financial and business crime, and is sometimes used more generally to include misuse of the financial system, including terrorism financing and evasion of international sanctions. Most anti-money laundering laws openly conflate money laundering with terrorism financing when regulating the financial system.

9 years ago