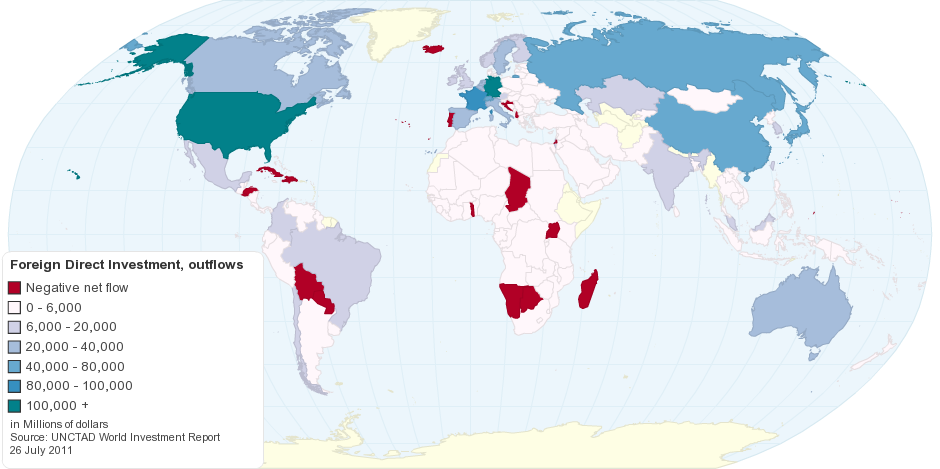

This interactive map shows outflows of foreign direct investment at the country-level, in million US dollars.

Global foreign direct investment outflows: US$1.32 trillion in 2010

Foreign direct investment (FDI) is a measure of foreign ownership of productive assets, such as factories, mines and land. Increasing foreign investment can be used as one measure of growing economic globalization.

FDI flows: For associates and subsidiaries, FDI flows consist of the net sales of shares and loans (including non-cash acquisitions made against equipment, manufacturing rights, etc.) to the parent company plus the parent firm's share of the affiliate's reinvested earnings plus total net intra-company loans (short- and long-term) provided by the parent company.

- For branches, FDI flows consist of the increase in reinvested earnings plus the net increase in funds received from the foreign direct investor.

- FDI flows with a negative sign (reverse flows) indicate that at least one of the components in the above definition is negative and not offset by positive amounts of the remaining components.

Note: Cross-country comparisons may not be accurate, because of differences in the definition of what constitutes foreign direct investment.

15 years ago