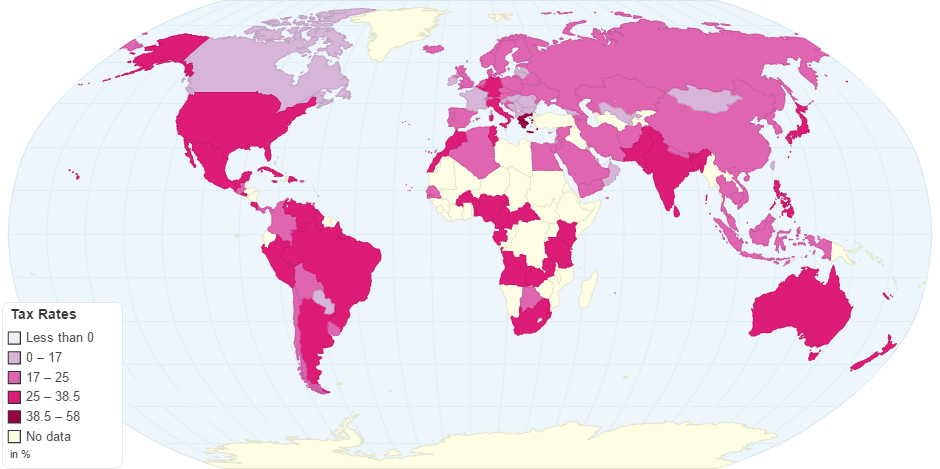

This chart shows Tax Rates by Country.

This is a list of tax rates around the world. It focuses on Two types of tax:

1. Corporate tax

2. Individual income tax

A tax is a financial charge or other levy imposed upon a taxpayer by a state or the functional equivalent of a state to fund various public expenditures.A failure to pay, or evasion of or resistance to taxation, is usually punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labour equivalent.

Most countries have a tax system in place to pay for public/common/agreed national needs and government functions: some levy a flat percentage rate of taxation on personal annual income, some on a scale based on annual income amounts, and some countries impose almost no taxation at all, or a very low tax rate for a certain area of taxation.

Some countries also charge a tax on corporate income, dividends, or distributions—this is often referred to as double taxation as the individual shareholder(s) receiving this payment from the company will also be levied some tax on that personal income.

Taxes are most often levied as a percentage, called the tax rate. An important distinction when talking about tax rates is to distinguish between the marginal rate and the effective tax rate.

The effective rate is the total tax paid divided by the total amount the tax is paid on, while the marginal rate is the rate paid on the next dollar of income earned. For example, if income is taxed on a formula of 5% from $0 up to $50,000, 10% from $50,000 to $100,000, and 15% over $100,000, a taxpayer with income of $175,000 would pay a total of $18,750 in taxes.

Tax calculation

(0.05*50,000) + (0.10*50,000) + (0.15*75,000) = 18,750

The "effective rate" would be 10.7%:

18,750/175,000 = 0.107

The "marginal rate" would be 15%.

9 years ago